Enrichment

Enrichment

Whether validating identity, enriching claimant information or confirming loss facts and details, ClaimsX helps your teamdeliver the right touch, every time.

Whether validating identity, enriching claimant information or confirming loss facts and details, ClaimsX helps your team deliver the right touch, every time.

Enrichment

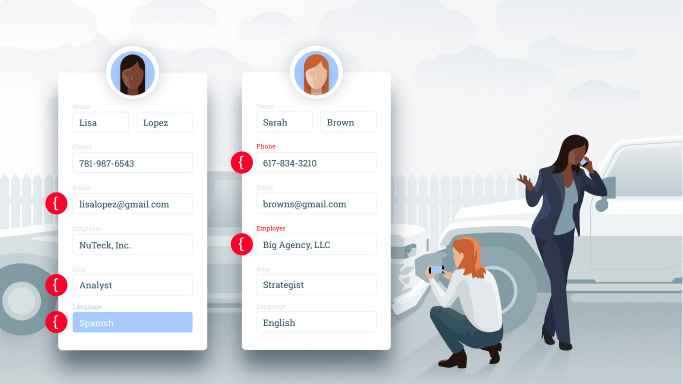

Little is often known about a claimant at FNOL, especially if they’re a 3rd party. Historically, it could take hours of intensive manual research to verify a claimant’s identity. We knew there had to be a better way, so we got to work.

With this in mind, ClaimsX’s enrichment data products access previously unknown data to drive automation and improve operational efficiencies. Once integrated, identity verification and robust claimant profiles come together in seconds, not days.

By accessing previously unknown data, you can proactively validate information, rather than rely on the claimant to provide it. And with a more complete picture, efficiencies can be uncovered and actualized. For instance, a claimant who prefers speaking Spanish can be quickly identified and proactively routed to the right agent for a better customer experience.

WHAT DOES THIS MEAN FOR YOU?

Here are just a few of the benefits you’ll enjoy when you’re powered by ClaimsX Enrichment:

DATA ENRICHMENT

Access to new data means a more complete picture of the claimant and potential to enhance existing models.

IMPROVED CLAIMANT PROFILE ACCURACY

Be one step ahead by proactively verifying information, and only ask applicants the most relevant questions to fill the gaps.

REDUCED CYCLE TIME

With a more complete picture of the claimant available upfront, claim handlers can expedite trusted profiles and devote more time to managing the rest.

Enrichment Product Elements

“Allstate is always searching for better ways to leverage the power of data to improve our claim process... Carpe Data helps support Allstate’s ongoing efforts to seamlessly integrate data to help our people make the best, most accurate and timely decisions.”

Glenn Shapiro, President

Personal Property-Liability

“By integrating new data elements from Carpe Data into our insurance programs for small businesses, we can better understand the challenges faced by business owners and identify options to address their commercial insurance needs.”

Sharon Fernandez

President of Business Insurance

"Carpe Data is the latest addition to Zurich’s ongoing innovation programs focused on transforming the future of insurance...[Carpe Data] supports Zurich’s ongoing efforts to improve the claimant experience by expediting low-risk claims, and by providing new insights to help our people make informed, accurate, and timely decisions."

Scott Clayton

Head of Claims Fraud, UK

"Carpe Data has been a great partner in helping us strengthen the claims handling process...ClaimsX helps [us] continue to meet our goals of increased efficiency, reduced potential fraud and improved customer experiences.”

Douglas L. Kratzer

Vice President, Claims

Other ClaimsX Products

Designed to automate the categorization of claims after FNOL, ClaimsX’s automated decisioning data products leverage our proprietary list of more than 500 features to aid in the segmentation of claims based on your business’s unique propensity for risk.

Empowering claims handlers, our monitoring products use current and reliable evidence-based data to corroborate or dispute loss factors. With access to millions of sources, they also continuously monitor real-time claimant activity and alert you when new, actionable insights are found.