New Data-as-a-Service offering provides automated decisioning, data enrichment, and real-time claims monitoring.

Santa Barbara, CA — October 28, 2019 – Carpe Data, a provider of innovative emerging and alternative data products for the insurance industry, is pleased to announce the immediate availability of ClaimsX, Carpe Data’s new Data-as-a-Service (DaaS) claims decisioning platform.

“The core premise of Carpe Data is to build data products to unlock operational efficiency and drive automation,” said Max Drucker, CEO for Carpe Data. “ClaimsX pulls all the pieces of the claims process together by providing automated decisioning, data enrichment, and monitoring throughout the entire claims lifecycle, from FNOL to resolution.”

Through sophisticated data analytics and artificial intelligence (AI), Carpe Data’s ClaimsX platform refines complex social, web, and publicly available data from previously unstructured sources to support automated claims decisioning and provide monitoring capabilities for P&C insurers, enabling them to resolve low risk claims quickly and reduce end-to-end cycle times.

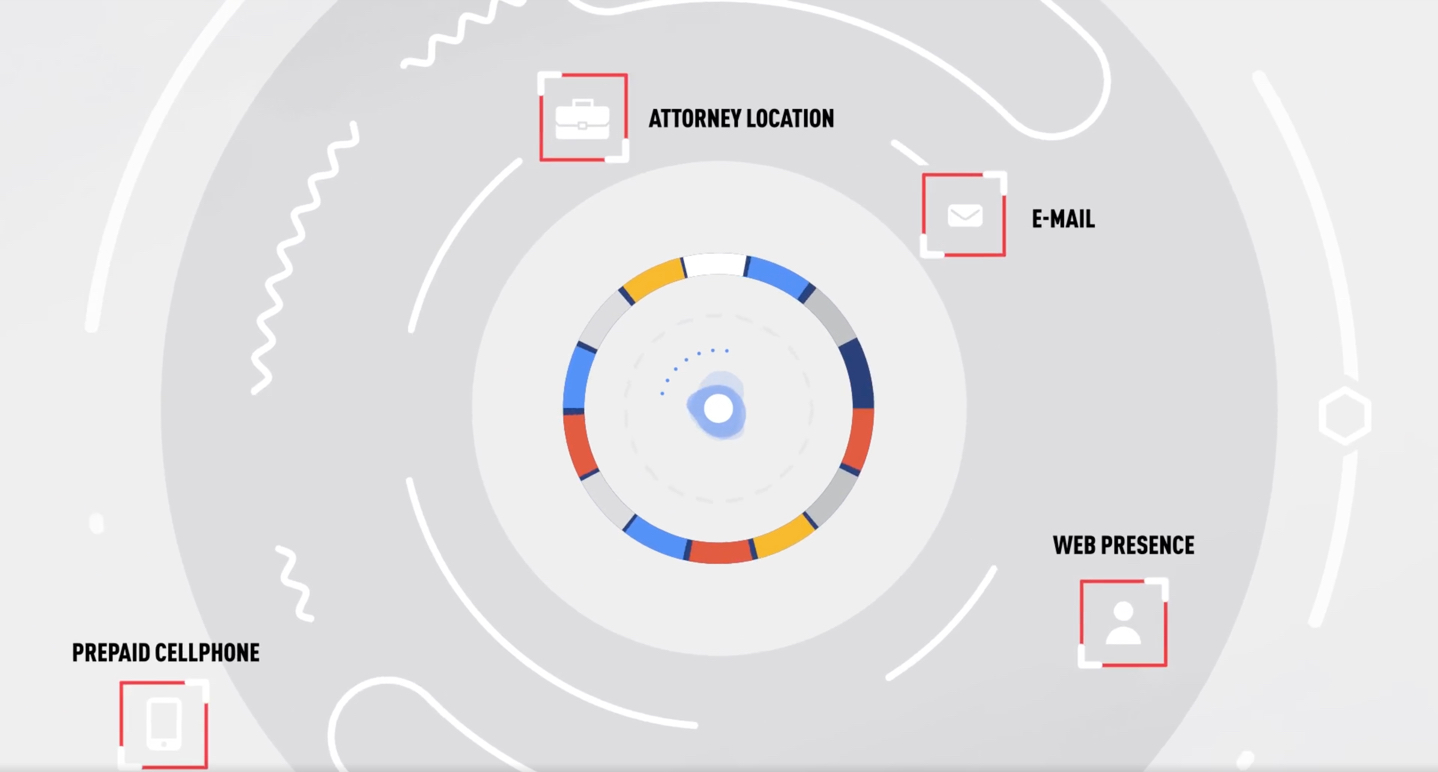

ClaimsX delivers powerful data enrichment by providing access to actionable information like claimant email and phone intelligence, employment and web presence, and vehicle information including sales and aftermarket add-ons. Additionally, ClaimsX allows insurers to follow injury claims throughout the entire lifecycle to confirm loss facts and identify possible exaggeration or fraud. ClaimsX can also be useful in other lines, like Auto Physical Damage and Property, to help track high-value property items and potential recovery opportunities.

ClaimsX drives automation at every stage of the claims lifecycle, determining when human touch is needed and providing insight through real-time monitoring of injury claimants, repair facilities, and more.

For more information about Carpe Data’s products for P&C insurers, or ClaimsX specifically, please visit the company’s website at www.carpe.io.

# # #

About Carpe Data

Carpe Data harnesses the power of emerging and alternative data for insurance carriers around the globe with powerful, proven AI. Through access to continuous monitoring and predictive scoring, insurers gain deeper insight into risks in real-time and significantly enhance many aspects of the insurance life cycle including underwriting, claims, and book assessment.